Readers,

The time has finally come for me to move my blog. Please come on over with me. Don't forget to change your links and RSS feeds. Here's the new address:

Thursday, December 20, 2007

This Blog Has a New Home: www.schaefersblog.com

Posted by

Cameron Schaefer

at

6:35 PM

26

comments

![]()

Tuesday, December 11, 2007

Create and Maintain a Budget Using Wesabe

For the past several months my wife and I have been using the free, easy-to-use, web-based software called Wesabe. Many of you have been asking me about it lately so I decided to give a brief overview of what it is and why I like it.

For the past several months my wife and I have been using the free, easy-to-use, web-based software called Wesabe. Many of you have been asking me about it lately so I decided to give a brief overview of what it is and why I like it.

First, I'm a firm believer in the importance of spending your money intentionally, rather than being surprised by your purchases at the end of each month. In order to do this a detailed budget must not only be created, it must be constantly maintained. There are many different programs out there to help you in this endeavor like Quicken and MS Money, but Wesabe is free and it adds the community element which I'll explain later. Before I forget, here's the link to a quick 3-minute video tour of Wesabe if you're more of a visual learner: VIDEO TOUR

Some of the highlights of Wesabe:

All Your Accounts in One Place - Wesabe is nice because it allows you to view all of your bank and credit card accounts in one place making it easy to budget, categorize and view all of your spending rather than having to skip from site to site.

Creating Spending Categories - When you first upload an account (checking, savings,

credit card, etc.) with Wesabe it displays the transaction exactly like it reads on your financial statement, often meaning pointless numbers and codes with no relevance to you. Wesabe then allows you to edit the transactions individually changing the bank code into something you can use like, "McDonald's" or "Apple Store". What makes Wesabe great is that from that point on it will recognize if a similar transaction comes though and will assign it the name you chose automatically; meaning, if you receive a paycheck on the 1st and 15th of each month from the same place Wesabe will recognize this and call the transaction "Paycheck" (or whatever you assign).

Also, as part of the editing process Wesabe enables you to "tag" each transaction, putting it in a specific category like "Restaurant" or "Entertainment." This ability to create spending categories is obviously key in creating and maintaining a detailed budget. The tag process also "learns" as you use Wesabe more, automatically assigning repeat transactions the right tag. For example, if you go to Chili's every week you will only have to assign the first transaction a name and tag, after that it will do this for you as it recognizes the same purchase item or place.

Creating Spending Limits - Another handy tool Wesabe offers its users is the ability to create spending limits. Users can assign each "tag" or spending category a certain spending limit for the month and Wesabe automatically keeps track of where you are as you make your purchases. If you set a "Restaurant" limit of $150 for the month, Wesabe will let you know that you only have $50 left for the month if you go out one night and spend $100 on a meal. This is probably my favorite feature as it eliminates the guessing of where you are at any given point in time in regards to your budget...helping you spend intentionally

The Community Element: Tips and Goals - Wesabe is unique from traditional budgeting software in that it relies on its community of users to provide guidance and tips on how to successfully manage your money. The "Tips" section of Wesabe looks at common themes in your spending and automatically provides user-generated tips specific to you. So, if you're a single-person with no kids you won't be receiving advice on saving money on diapers or budgeting for your kids' college tuition.

The community also comes into play in the "Goals" section of Wesabe, a place where you can create and monitor your personal financial goals. The wife and I currently have goals including buying our first house and maximizing our yearly Roth IRA contributions. Wesabe allows you to connect with other users with the same goals giving you an opportunity to discuss, share and learn.

Overall, we've been very pleased with Wesabe. Every once and a while it mis-tags a purchase, but that is rare and easy to fix. The only other problem we ran into was having one transaction come up twice in "Bills" and "Payments"...we fixed this using the filter feature, filtering out the "Payments" from our spending and earning summaries. Finally, many have questioned the security aspect of uploading financial accounts onto the web...understandable, but Wesabe takes security just as seriously as any of your financial institutions that you bank with daily. Check out there security policies here: https://www.wesabe.com/page/security.html

Posted by

Cameron Schaefer

at

6:13 PM

69

comments

![]()

Labels: finance, Personal Development

Saturday, December 8, 2007

Who is Ron Paul?

If you are like me you are watching the presidential election like you watch a round of golf on tv, checking out the leader board from time to time, but mainly just using it as some good background noise for a Sunday afternoon nap. I thought I knew what was going on for the most part until I started seeing the name Ron Paul everywhere on the Internet. I am still trying to figure this guy out, but if you would like to know more as well here is his "Issues" page from his official website explaining what he believes. Enjoy! Vote!

http://www.ronpaul2008.com/issues/

Thursday, December 6, 2007

The Dollar is Falling....Big Deal

Tyler Cowen, author of Discover Your Inner Economist: Use Incentives to Fall in Love, Survive Your Next Meeting, and Motivate Your Dentist

Tyler Cowen, author of Discover Your Inner Economist: Use Incentives to Fall in Love, Survive Your Next Meeting, and Motivate Your Dentist, wrote a great piece in the New York Times a few days ago entitled, "The Dollar is Falling, and That's Good," about the current hullabaloo regarding the falling value of the greenback. Its been in the news a ton lately and financial sages like Buffett have been warning about the precarious position a devalued dollar puts us in with countries like China holding so much of our debt in their hands. I admit, I've had mixed feelings about the real impact of a falling dollar wondering often, "Is this really something I need to be worrying about?" Cowen puts things in perspective:

ANXIETY about the dollar continues to spread. The falling greenback is often seen as a sign of an impending recession or the fall of the United States from global leadership. A low dollar simply looks bad. We are, after all, used to judging ourselves against others — comparing our salaries with the earnings of our peers, and our homes with those of our neighbors. We’re used to thinking it is a big advantage to stand at the top of a numerical list.

But when it comes to currencies, a higher value neither brings national success nor predicts future prosperity. The measure of a nation’s wealth is the goods and services it produces, not the relative standing of its currency. Take a look at 1985-88, when the dollar lost more ground than in the last few years. Those were good times, and the next decade was largely prosperous as well.

Today’s lower value for the dollar reflects the success of other regions. Europe has shown it can make the European Union and its unified currency work, and thus the euro has become stronger. The Canadian union appears increasingly stable, and that means a higher value for the Canadian dollar. Over all, these geopolitical developments are good for America even if the dollar becomes weaker in relative terms.

As to the concern that China could lay the wood to America by dumping the dollar:

Another worry is that a falling dollar puts the United States at the mercy of China. Dr. Brad Setser, a currency analyst at RGE Monitor, estimates that the Chinese hold about $1.2 trillion in dollar-denominated assets. China is likely to slowly diversify into other currencies, but Chinese leaders have no interest in encouraging a run on the dollar or a fire sale of dollar-denominated assets. China is in a more vulnerable position than the United States, if only because China is a poorer country and has underdeveloped capital markets.

Cowen concludes that all of the people claiming the sky is falling need to relax:

Still, it would be naïve to argue that a weak or falling dollar can never hurt the United States. Extreme volatility can increase general anxiety and discourage economic commitments. If the dollar went into a true free fall, it would damage the reputation of the United States as a desirable place for foreigners to invest. That would hurt; but on the other hand a low dollar would mean bargains for foreigners, thereby attracting investment and limiting the potential negative fallout from a dollar collapse.

SO far the Federal Reserve and the Bush administration have shown little concern over the falling dollar. This isn’t because of neglect or lack of interest; trillions of dollars worth of currency are traded every day, so policy makers have only a limited ability to push around long-term exchange rates, even if they wanted to do so.

When it comes to market prices, people can always find reason to be unhappy. In the eurozone, for example, it is a common complaint that the euro is too strong and therefore it is too difficult for Europeans to export goods and services.

In the case of the dollar, we need to stop thinking of its value as a marker of economic success. The American economy has its problems, but so far the low value of the dollar has proved more a benefit than a cost.

Tuesday, December 4, 2007

Weak Ties Experiment: Ben and Ramit

And now in the spirit of learning and discovery I offer this experiment to help prove the power of weak ties. I am going to send my "Creating and Cultivating 'Weak Ties,'" post to two of my favorite bloggers, Ben Casnocha, author of My Start-Up Life: What a (Very) Young CEO Learned on His Journey Through Silicon Valley and Ramit Sethi of I Will Teach You to Be Rich

I have a weak tie with Ben through Paul Berberian, a former USAFA grad who came back frequently to speak to our Management classes. It was through Paul that I learned about Ben's blog which I follow avidly. Ramit I know only through his blog. I suppose both of these are "weak" weak ties since they are one-sided, but we'll go with it for the sake of the experiment. Anyway, at this time I get on average 10-15 readers a day on my blog. My hypothesis is if I can get Ben and Ramit to link to my article either by a direct mention in their blog, delicious link, or some other means, my traffic will double for at least 3 days after their link is published simply due to the access I will receive to their blog audience. In doing so my life will be improved by more blog traffic, exposure, etc. and I will have cultivated a weak tie that could be of value in the future. Will let you know how this one turns out!

Posted by

Cameron Schaefer

at

10:00 PM

1 comments

![]()

Labels: Blogging

Creating and Cultivating "Weak Ties"

Since I finished pilot training I have had some time for myself to study, think, write and review. One thing I have felt strongly about is going back over some of the books and ideas I found most interesting over the past few years. For example, I read The Tipping Point: How Little Things Can Make a Big Difference

Since I finished pilot training I have had some time for myself to study, think, write and review. One thing I have felt strongly about is going back over some of the books and ideas I found most interesting over the past few years. For example, I read The Tipping Point: How Little Things Can Make a Big Difference by Malcom Gladwell a while back, but if someone asked me to summarize the ideas today, I would be limited to the subtitle, "How Little Things Can Make a Big Difference, " and a few smatterings from the book on Mavens and broken-window theory...not exactly high quality or usable information...so I'm reviewing in order to be able to actually use and apply Gladwell's ideas rather than just recalling how interesting they were at the time.

One of my favorite sections of the book involves the Law of the Few where Gladwell lays out the 3 types of people necessary to start a social epidemic: Connectors, Mavens and Salesmen. Connectors fascinate me because I relate to them the most. Connectors, in Gladwell's words are, "people with a special gift for bringing the world together." Connectors know lots of people, naturally, and, "for one reason or another, they manage to occupy many different worlds and subcultures and niches." For me the most important aspect of connectors is their gift of creating and cultivating what sociologists call a "'weak tie,' a friendly yet casual social connection."

It is my opinion that weak ties are an invaluable source of social capital one must cultivate if he or she has any chance at success. More from Gladwell:

In his classic 1974 study Getting a Job, Granovetter looked at several hundred professional and technical workers from the Boston suburb of Newton, interviewing them in some detail on their employment history. He found that 56 percent of those he talked to found their job through a personal connection. Another 18.8 percent used formal means...This much is not surprising; the best way to get in the door is through a personal contact. But, curiously, Granovetter found that those personal connections, the majority were "weak ties." Of those who used a contact to find a job, only 16.7 percent saw that contact "often"...People weren't getting their jobs through their friends. They were getting them through their acquaintances.

In short we don't rely on friends when it comes to new jobs, new information or new opportunities because in large part, they occupy a world very similar to ours. Weak ties are incredibly important for the simple fact that they are generally connections to a world outside of our own, a diverse form of social capital allowing us access into places we normally could not go. In a world of globalization geography is becoming less important and relationships are becoming more important. As the pool of high-skilled workers increases (aka China and India) who you know will become a key way to differentiate yourself from the other thousand people with similar resumes, making the number of your weak ties a valuable asset in determining your success in business and in life. Knowing the importance of weak ties, here are some ways to get better at creating and cultivating them:

1) Meet more people - go to church, attend art shows, join a book club. Expose yourself to various degrees of social randomness, groups and people that you would normally not associate with, people outside your normal social circle. Remember, you are not looking for a new best friend, only casual friendly connections. If your normal Friday night routine involves staying at home and watching a movie in your sweat pants, mix it up a bit and go out every other week. Extra tip: people tend to connect more easily if they are holding a beverage in their hand...it seems to create a small barrier making people more comfortable when conversing.

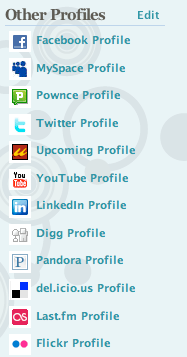

2) Organize your contacts - meeting mass amounts of people will do you no good if you do not come up with some sort of system to remember them. LinkedIn is a very useful online tool I just joined. They help you track down old classmates and colleagues, create connections, organize and maintain detailed contact information. Obviously there are a million social networking options today from MySpace to Facebook to Twitter...use them all. Also, most smart phones today have great contact systems as well, utilize them and keep them updated.

3) Weak tie, not dead tie - Find a way of keeping the ties alive over the years. For example, Mr. Horchow, a connector Gladwell studied in Tipping Point would keep track of his contacts birthdays and send them a birthday card. This seems easy enough you might say...Horchow had a contact list on his computer of over 1,600 names! Maybe this isn't your style, but find something even if it is only a yearly e-mail updating them on your life, or a Christmas card, whatever you have to do to keep the tie healthy enough that when you call on that person for a favor sometime down the road they don't respond with, "who did you say you were again?"

4) The magic of remembering a name - We all know how good it makes you feel when someone you only met once remembers your name....become that person. I heard a story once of a Wing Commander at an Air Force base in North Dakota that memorized the names of every single airmen under his command...and their spouses! We're talking thousands of names people! He obviously had come up with a system, placing a name with a fact about the person, reviewing photos, something. Whatever he did, his ability to know his subordinates' names made an incredible impact. The moral was very high and every airmen wanted to work hard for the Commander because they felt like he cared. If you can learn to remember people's names it will make you a person people want to remember.

Go forth people and establish your weak ties! Comment with your ideas, systems and thoughts.

Posted by

Cameron Schaefer

at

7:26 PM

![]()

Labels: Personal Development

Sunday, December 2, 2007

My Best Books of 2007

Its about that time again when much of the media will be focused on creating their year-in-review pieces. Like my blogging friend, Ben Casnocha, I love "Best of" lists. So, without further attempts to write for the sake of hearing my fingers hit the keys, here is a list of my favorite books I read in 2007: Troublesome Young Men: The Rebels Who Brought Churchill to Power and Helped Save England

Troublesome Young Men: The Rebels Who Brought Churchill to Power and Helped Save England by Lynne Olson

My latest read, a story about the band of young MP's in Britain that broke party ties on the eve of WWII in order to topple the Chamberlain-led appeasement government and make way for Winston Churchill. Starts out a bit slow, but gains rapidly after the first 6 chapters. Incredible insight into the internal struggles many of the young politicians faced in going against their party and standing for what they believed was England's only chance at survival, all-out war against Nazism. The book raises interesting questions concerning loyalty, party politics, the role of the press and leadership. Lynne Olson has made great tale in describing the behind the scenes workings of a few that helped change the world for so many.

Bobos In Paradise: The New Upper Class and How They Got There by David Brooks

Go to any college campus, resort town, or urban-chic hotspot in America today and David Brooks' "Bobos In Paradise," could act as an incredibly detailed and relevant tour guide. Everyone knows a Bobo whether they realize it or not...in fact they may be one themselves, though they would never admit it. After reading this book I realized that I am in fact a Bobo. Brooks cracked the code for me on things I had always noticed, but never been able to put into words regarding the new class of society forming in America; the exotic coffee drinking, urban outfitter/anthropologie wearing, mutual fund owning, I go climb Himalayan ranges barefoot and drink yak's milk tea with the sherpas over Spring Break for fun because all the "tourists" stay in Kathmandu, class of society. The people that will not like this book are the ones that take themselves way too seriously...most likely because they are probably Bobos too, but too proud to admit it. Entertaining to say the least!

Londonistan by Melanie Phillips

Shocking commentary on the rise of radical Islam in London. Finally, someone who is not afraid to call a spade a spade. Melanie Phillips should be commended for her courage and tenacity in tackling head on an ideology that is seldom confronted out of fear of being labeled "intolerant." Ideologies of hate simply cannot coexist with freedom. "Londonistan" shows the front lines of a culture war that has been brewing for centuries and is nearing its critical mass. This book should sound as a warning for every American, highlighting the consequences of appeasement and the philosophy of moral and cultural relativism. Prepare to walk away angry and shocked.

The Brothers Karamazov (Everyman's Library) by Fyodor Dostoevsky

Not much to say on this book, its a classic for a reason. Dostoevsky has an amazing ability to take characters and make them your friend, brother, father, etc. The story of a Russian family and their struggles for power, money and blood. Some of the greatest writing I have ever experienced. Examines nearly every big philosophical question: meaining, purpose, good, evil, God, man. If you read one classic, read this.

The Black Swan: The Impact of the Highly Improbable by Nassim Taleb

Most predictions are flat out wrong, just listen to any "expert" on CNBC give a prediction of where the market is headed on a given day. Yet, we love predictions because they help us feel like we understand what's going on around us much better than we actually do...the idea of randomness is uncomfortable. The reason our prophecies fall so short is our lack of understanding of the Black Swan and its impact on both history and the future. The Black Swan as Taleb describes it is:

1) an outlier 2) carries extreme impact 3) produces explanations only after the fact.

The bulk of Taleb's book explains in great detail, clarity, and wit the error most humans make in failing to account for the Black Swan in their thinking. He explores various theories ranging from our eagerness to interpret the "causes" in history (confirmation bias, narrative fallacy, etc.) to our inabilities to predict the future (the expert problem, herding and the character of prediction errors).

Finally, Taleb doesn't stop with mere theory; he gives the reader help in how to think in a Black Swan world. His advice, make black swans gray by being aggressive in gaining exposure to positive Black Swans and extremely conservative when under the threat of a negative Black Swan. You're probably reading this right now going, I think I know what he is talking about, but you don't, just read the book and be prepared to have your comfort zone shattered and your mind exercised.

New Comments Platform: Intense Debate

Readers of Schaefer's Blog,

I have decided to add Intense Debate to the blog as a new way of doing comments. If you haven't signed up for an account I highly recommend it. Intense Debate allows users to track their comments, have one place to save them all no matter what blog they commented on, gain reputations based on the quality of comments, and thread comments together. If you would rather not use this feature simply click cancel and post your comments as you normally would.

I've seen this used on some other blogs I read like BrianReeseBlogs and it makes comments much more dynamic, allowing good content to stand out. Please let me know if you have problems with the new platform or questions. Thanks

Saturday, December 1, 2007

My Assignment: C-17 McChord AFB

After 13 months of Air Force pilot training, over 200 hours of flight time in the T-6 and T-1, countless 12-hour days, check rides and hundreds of thousands of dollars of jet fuel, I finally found out tonight, at our class' Assignment Night, the plane I will fly for the Air Force: C-17's at McChord AFB in Tacoma, WA. I am incredibly excited and grateful as this was one of my top picks on my dream sheet. Overall our class got great drop with nearly everyone getting their top choice of plane.

The C-17 is an awesome plane, the newest of the Air Force's airlift fleet. It has the most advanced avionics, electronics, capabilities of any of the heavy aircraft. The main feature of the C-17 is its ability to land on small, dirt strips in remote operating areas while carrying up to 170,000 lbs of cargo...oh yeah, and it can stop in approximately 3,000 ft. For more stats and info on the plane check out this page on Wikipedia. Definitely more to come on my new plane, but just enjoying the moment for now. Thank you to all the taxpayers of America that let me fly around everyday as my job!

Definitely more to come on my new plane, but just enjoying the moment for now. Thank you to all the taxpayers of America that let me fly around everyday as my job!

Posted by

Cameron Schaefer

at

12:45 AM

51

comments

![]()

Monday, November 26, 2007

Creating S-M-A-R-T Goals

One of the keys to living well is setting goals for yourself. Its not a new idea, yet so few of us do it well. I think the reason for this is simple: failure. All of us have set goals before and fallen short. Every New Years millions of people resolve to lose weight, watch less television, spend more time with loved ones and by mid-Spring 99% of those goals have gone by the wayside. What's wrong with this picture? Are some people just lazy? Absolutely, but I think many times the problem lies in the goals themselves rather than the people trying to achieve them. When its unclear exactly what you're striving for it is much easier to give up when things get hard.

One of the keys to living well is setting goals for yourself. Its not a new idea, yet so few of us do it well. I think the reason for this is simple: failure. All of us have set goals before and fallen short. Every New Years millions of people resolve to lose weight, watch less television, spend more time with loved ones and by mid-Spring 99% of those goals have gone by the wayside. What's wrong with this picture? Are some people just lazy? Absolutely, but I think many times the problem lies in the goals themselves rather than the people trying to achieve them. When its unclear exactly what you're striving for it is much easier to give up when things get hard.

During my time at the Air Force Academy I once heard a lecture that explained a way to set SMART(Specific, Measurable, Achievable, Relevant and Timebound) goals. The principle was being explained in the context of setting quality objectives at the start of a war, but I believe it translates well into ordinary life. An explanation:

Specific - something that can be easily observed, linked to a unit, percentage, time, etc. For example, "Lose weight" = BAD "Lose 50lbs" = GOOD

Measurable - Will you be able to track your progress toward the goal and know when you've achieved it? It must be possible to monitor and measure your goal. "Lose 50 lbs" is good because you can easily step on a scale each week to measure your progress.

Achievable - Is the goal something that can reasonably be achieved? If not, scale it down a bit. This does not mean it has to be easy, but an impossible goal motivates no one.

Relevant - Will achieving this goal bring you closer to where you want to be? Your goals should tie into a larger objective for your life. For example, if you are trying to spend more time with your family, a goal of taking on more clients at work may take you further from where you want to be.

Timebound - Every goal must have a specific time frame. Time motivates you by giving you a clear target and a sense of urgency. Without a time frame goals tend to be pushed back, put off and eventually forgotten. Ask any runner, if you have a goal to run a marathon, you have to sign up for one or you'll never do it. The approaching race date acts as an incredible motivator during the training process. Without it, you may run, but chances are you'll never reach your ultimate goal.

In the next month I plan on taking a closer look at goals, objectives and how to place systems in your life that will help you live your best, the high life as I like to call it. Stay tuned and please leave comments on your successes and failures in the realm of goal-setting.

Posted by

Cameron Schaefer

at

8:00 PM

2

comments

![]()

Labels: Personal Development

Saturday, November 24, 2007

What I Learned From My High School Football Coach

There are times in life when it is good to step back and figure out where you are, how you've gotten there and what you've learned along the way. The past few weeks have been one of those times for me. Upon reflecting on lessons learned the wisdom of my high school football coach, John Deti, kept coming to mind. There are two types of teachers in the world: those whose advice and lessons go in one ear and out the other and those whose words stick with you your entire life. Coach Deti fell into the latter category. It was not the way he spoke or his method of delivery, it was the simplicity of his words and the integrity of the man speaking the words. As his players, we trusted him. These are the lessons he taught us:

1) It's simple, but it's not easy - When you break down a play in football into its most basic parts its really not rocket science. The ball is snapped, the line blocks, the running backs either take the ball and run towards a point in space or block, receivers run routes and the quarterback just gets the ball to where it needs to go. Yet, something happens in the midst of all this: 11 guys on the other side of the ball do their best to ruin all of your plans. The thing about plans is that they're made in a static environment, reality is dynamic, constantly changing. Every decision and move you make has unintended consequences that cannot be conceived beforehand. Life in many ways is a series of plays. Businesses, governments, scientists, etc. all design their own "plays" that seem simple in theory, but then competitors slash prices, Israel bombs Iran, and a new scientific property is discovered...your plans are left in a smoldering heap on the floor. Coach Deti knew that plans are the easy part, actual execution is where the real money is made.

2) It's the little things that matter - Coach Deti was well ahead of Malcolm Gladwell in understanding that the little things in life can make the biggest difference. Drill after drill, practice after practice, this message was ingrained in the mind of every Plainsmen football player. "If you take care of the little things, the big things will take care of themselves," he would remind us as we ran the same play for the 26th time in a row. Everyone wants to score a touchdown, but few people are willing to work out the details required to make it happen. Making a great block just doesn't have the same glamor as catching a pass in the end zone, but the one simply cannot happen with out the other. In life, big dreams are a dime a dozen, but rare is the person who has the discipline and patience to grind it out each day doing the little things well over a long period of time.

3) Nothing is ever as good or bad as it seems - Out of all the sage words spoken by Coach, these have echoed in my mind the most as I've walked through life. We all know those people whose everyday is either the best or worst day of their life. If you do not know anyone like this, its probably you. These people annoy me. Humans are incredibly susceptible to hype, we all fall for it. The car that doesn't quite drive like you imagined it would after watching the commercial; the life-changing promotion that soon turns into nothing more than extra meetings and longer hours.

Going through 4 years at a military academy was one of these, "nothing is ever..." experiences for me. Admittedly, I was nervous going into it, none of my immediate family had been in the military so most of my information was from people who had a friend of a friend whose Uncle Jim went through in '68. "Best four years of my life!" I would hear. "Hardest thing I've ever done!" "I heard they cane the freshmen each morning before breakfast." Well, I made it through the four years. Was it hard? Yes. Was it the best four years of my life? Yes, but for entirely different reasons then I had been expecting. All this to say, our expectations often greatly exaggerate reality so do not rely to heavily on them.

4) Never pass up a free meal - Of all the words spoken by Coach, none seemed so insignificant at the time and made so much sense later. "Never pass up a free meal," he would say to us before an athletic banquet or school function. It was his way of getting a group of rowdy high school boys to go sit through a meal for a few hours with a bunch of adults. I really don't know anyone that enjoys that slice of American high school culture called the, "athletic banquet." Dressing up to go sit on uncomfortable school cafeteria chairs in order to listen to a dozen coaches explain why even though they went 1-10 this year their team was, "a special group of kids." All of this while eating lasagna and jello salad (pot luck favorites) and waiting for your turn, when your coach would call you up and hand you your certificate, shaking your hand and turning toward the crowd for the quick parental photo-op. At times it all seems ridiculous, but the spirit behind the event is what makes it good.

It is often said that nothing in life is free. This is true for the most part, but sometimes people just want to bless you. These opportunities are rare and should not be dismissed too quickly. There is nothing as tacky as when people try to honor someone and they don't show up or are ungrateful. I admit, I didn't like athletic banquets, but I was always thankful for the people that put the time and effort into honoring our hard work. One of the keys to succeeding in life is understanding when to go with the flow, sometimes this means humbling yourself and not passing up the free meal.

5) Things will go wrong, expect it and move on - Before the start of every game the team would gather around Coach Deti in the locker room as he talked to us. I hesitate to call it a pep-talk because it was something different. He focused us in on where we were and what we were doing. One thing he always told us was that during the course of the game things were going to go wrong. Not exactly what you'd expect a coach to tell his team to motivate them, yet I remember the pressure that those words took off our shoulders as players. It freed us up to play the game to win rather than play not to lose. He didn't expect perfection, he expected his team to play each down to the best of our ability, picking ourselves up and moving on after a mistake.

At the time, I had no idea how true these words would ring out in my personal life. In the Spring of 2003 my mother passed away from cancer. I was finishing my freshman year at the Air Force Academy and came back to Laramie for several days to be with family, friends and attend the funeral. It was decided that Coach Deti would speak at the funeral. You see, John Deti was not only my high school football coach, he is also my godfather. The days surrounding that event seem like a blur when I think back now, except for a few distinct moments. At the funeral, as Coach stood behind the podium to speak, everyone was silent. "Julie was a friend of mine," he paused. It was the first time I'd seen this great man visibly shaken, the ripple effect was tremendous. He went on, but to me he had already said everything that needed to be said. Things do indeed go wrong, knowing this doesn't make the "wrongness" any easier, but it frees you up to play the game, to win rather than not to lose. And that is the only way to really live.

Posted by

Cameron Schaefer

at

1:33 PM

1 comments

![]()

Labels: Life

Wednesday, November 21, 2007

A Schaefer Thanksgiving 2007

Tomorrow is Thanksgiving. I love it! Family, friends, food, naps, food, football, parades....it is second only to Christmas in my mind. For my wife and I this Thanksgiving will be one of many "firsts." The first Thanksgiving apart from our immediate family, the first Thanksgiving in our own house, the first Thanksgiving with our friends James and Sara and the first Thanksgiving in Enid, OK. It will also be a day of "lasts." The last Thanksgiving in Enid, OK (no offense, Enid is a nice place, but this "last" doesn't cause me too many tears) and most importantly the last Thanksgiving without a kids table. We'll be having a baby girl in January.

Tomorrow is Thanksgiving. I love it! Family, friends, food, naps, food, football, parades....it is second only to Christmas in my mind. For my wife and I this Thanksgiving will be one of many "firsts." The first Thanksgiving apart from our immediate family, the first Thanksgiving in our own house, the first Thanksgiving with our friends James and Sara and the first Thanksgiving in Enid, OK. It will also be a day of "lasts." The last Thanksgiving in Enid, OK (no offense, Enid is a nice place, but this "last" doesn't cause me too many tears) and most importantly the last Thanksgiving without a kids table. We'll be having a baby girl in January.

There is a special connection in my mind between holidays and family, it has always been there, but with my first child on the way it has transformed a bit. The prospect of being the head of my own family takes things down a new road. My heart really grows when I picture future holidays with MY family. Our kid(s) sitting around the table laughing, taking after their father and not eating any vegetables. Marelize busy being the super-chef that she is. And someday, our kids and their spouses and MY grandchildren all together. In a sense, the Norman Rockwell Thanksgiving. Even the thought of being able to sit at the head of such an incredible imaginary family brings great pride.

I realize that the Rockwell Thanksgiving is an ideal, some may say unrealistic one at that, but to me it represents the best of America and what makes family so unlike any other relationship we experience. It also represents something we should preserve. As I go through life I have noticed time and time again that the family unit is completely unique and indispensable in its ability to produce happy, successful people. When the family unit suffers, the ripple effects are incredible. Family done well is important. To me the Rockwell Thanksgiving is saying one thing, family is good! They may fight, bicker, frustrate you incredibly, but family is good and always worth fighting for. Happy Thanksgiving from the Schaefer's!

Tuesday, November 20, 2007

Quote of the Day: Jim Elliott

"Wherever you are, be all there." - Jim Elliott (October 8, 1927 – January 8, 1956)

"Wherever you are, be all there." - Jim Elliott (October 8, 1927 – January 8, 1956)

Its easy to live for tomorrow, thinking about getting home when you're at work, dreaming of the weekend on Tuesday, wishing the vacation next month would be here today. The problem is when you constantly live in the future you tend to miss the opportunities in the present. Not to say we shouldn't plan ahead, but planning for the future is different than camping there. People can tell when you're listening to what they say so you can give your piece and move on and when you're listening to hear what they have to say. The people who inspire the most confidence, the most loyalty, are those who have a vision for the future, but live fully and completely each day of their lives in the present.

Sunday, November 18, 2007

Are Christians Poor, Ignorant and Violent?

There are few minds today I find as interesting as Dinesh D'Souza's. The long-time conservative author and speaker has recently released his latest book, What's So Great About Christianity

There are few minds today I find as interesting as Dinesh D'Souza's. The long-time conservative author and speaker has recently released his latest book, What's So Great About Christianity. Currently on the New York Times bestseller list, this piece has obviously stirred the pot putting Dinesh at the center of the God debate. A recent article from his blog described a radio debate he participated in on the Michael Medved show a couple weeks ago with the editor of Skeptic Magazine. Classic Dinesh:

"I debated atheist Michael Shermer, editor of Skeptic magazine, yesterday on the Michael Medved radio show. It was a two hour debate, and conducted at a high level that is not characteristic of radio programs. The main focus of the debate was my bestselling book What's So Great About Christianity, and in the course of the discusson we covered a lot of topics from the fine-tuned universe to why humans evolved morality to whether Adam and Eve were real people.

Shermer, always ready with his ream of data, uncorked some fascinating statistics about how Christians are more prone to social pathologies than non-Christians. For example, the more-religious United States has higher crime rates than the less-religious Europe. In America, evangelical Christians are apparently more likely to be uneducated and to have higher violent crime rates than non-Christians. Shermer even cited a study showing that secular doctors were more likely to do voluntary work than Christian doctors. Shermer went on and on about all this, and I was waiting for him to reveal that Christians have a greater tendency to bestiality than secular folks, but to my surprise Shermer had no data on this subject.

Actually U.S. crime rates today are not substantially higher than those of Europe. That's because there has been a marked decline in violent crime in America. But even the old statistics prove nothing, because the U.S. is an ethnically diverse society, immigrant societies always have higher crime rates, and European countries typically don't have the black-and-white problem that is peculiar to America. Yes, evangelical Christians in America may be poorer and less educated than non-Christians, but that may be because evangelical Christians are more concentrated in the South. One can hardly conclude that evangelical Christianity makes you poor and dumb. Finally C.S. Lewis made the point that a religion like Christianity which advertises itself as a remedy for human sin and brokenness is bound to attract more people who find themselves to be sinful and broken. Christianity attracts sinners for the same reason that doctors attract patients: one can hardly hang out at the doctor's office and then condemn the service because predominantly messed-up people keep showing up day after day."

Saturday, November 17, 2007

3 Investment Principles Every Young Person Should Know: #3 Dollar-Cost Averaging

Continuing on in the 3 Investment Principles series (If you haven't caught the first two here they are: Time Value of Money and Pay Yourself First) we come to the final principle: Dollar-Cost Averaging (DCA). The aim of DCA is to reduce the risk associated with a single, large investment by spreading out the investing (and risk) over time. Everyone has heard the token financial advice, "buy low, sell high." Seems simple enough, but in reality no one can predict exactly when a stock will bottom out. By investing a fixed dollar amount at regular intervals (weekly, monthly, etc.) regardless of share price, you will end up buying more shares when the price is low and less when the price is high, thereby maximizing your total return.

Continuing on in the 3 Investment Principles series (If you haven't caught the first two here they are: Time Value of Money and Pay Yourself First) we come to the final principle: Dollar-Cost Averaging (DCA). The aim of DCA is to reduce the risk associated with a single, large investment by spreading out the investing (and risk) over time. Everyone has heard the token financial advice, "buy low, sell high." Seems simple enough, but in reality no one can predict exactly when a stock will bottom out. By investing a fixed dollar amount at regular intervals (weekly, monthly, etc.) regardless of share price, you will end up buying more shares when the price is low and less when the price is high, thereby maximizing your total return.

An example of this from youngmoney.com:

"Dollar cost averaging works like this: systematic investments are made to an investment account. For this example we will say on a monthly basis. To keep things simple we will also say that the investment account is allocated 100% into one growth fund. We will use $100 as the monthly investment amount. Now, depending on how the market is doing that fund's price is going to fluctuate from day to day. So let's look at a six-month example in the table below.

Month | Price | Shares Purchased |

| 1 | 20 | 5 |

| 2 | 16 | 6.25 |

| 3 | 10 | 10 |

| 4 | 5 | 20 |

| 5 | 10 | 10 |

| 6 | 25 | 4 |

In the example above, you have invested $600 and your account is now worth $791.73. Over the six-month period, you paid an average of $14.33 per share. If you would have taken all $600 and purchased the shares at the beginning of the six months, you would have purchased 30 shares and your account would now be worth only $750. For this example, using dollar cost averaging has increased your account by over 5%! Of course the above scenario is just one example of using dollar cost averaging. There are many."

This isn't to say that this method of investing doesn't have its critics. DCA operates on two assumptions: 1) the investment (stock, mutual fund, etc.) follows an overall positive trend over the investment time frame, meaning, dollar-cost averaging isn't going to help if the investment you're putting money into ends up losing value in the long run. 2) If you happen to get extremely lucky and start investing at the bottom of a long-term price trend you would be better off buying a lump sum...good luck timing the market!! John Wagonner explains in USA Today, "Dollar-cost averaging typically does best when an investment goes sideways or down for years and then, at the end of the period, suddenly breaks to the upside."

As is the case with nearly everything in finance, time frame matters. "Regardless of the amount of money that you have to invest, dollar-cost averaging is a long-term strategy," explains Jim McWhinney for Investopedia.com, "While financial markets are in a constant state of flux, they tend to movie in the same general direction over fairly long periods of time. Bear markets and bull markets can last for months, if not year. Because of these trends, dollar-cost averaging is generally not a particularly valuable short-term strategy."

In the end I like DCA for one simple reason, it builds a habit pattern of investing in season and out of season. Its very easy to form the wrong habits in an affluent culture like our own. It seems everyone, but you, always has the latest gadget, toy, car, etc. Spending, saving, investing are all habits. The purpose of this 3-part series on investment principles is to help make good habit patterns, ones that create wealth and enable you to live the High Life.

Posted by

Cameron Schaefer

at

7:53 AM

![]()

Labels: finance, investments

Friday, November 16, 2007

Mo Lattes Mo Problems

As Starbucks launches its first-ever tv ad campaign, same-store sales growth is slowing and so is the stock price (down over 32% this year), raising the question of whether the titan of coffee is reaching its saturation point. With a goal of launching over 40,000 stores worldwide, CEO Howard Schultz expressed concern in an internal memo last spring that the rapid growth of the company (currently over 13,000 stores worldwide) has led to "the watering down of the Starbucks experience" for customers.

As Starbucks launches its first-ever tv ad campaign, same-store sales growth is slowing and so is the stock price (down over 32% this year), raising the question of whether the titan of coffee is reaching its saturation point. With a goal of launching over 40,000 stores worldwide, CEO Howard Schultz expressed concern in an internal memo last spring that the rapid growth of the company (currently over 13,000 stores worldwide) has led to "the watering down of the Starbucks experience" for customers.

Anyone that knows me, knows I have become an avid fan of Starbucks over the past few years. I used to mock Starbucks junkies, but after discovering the breve mocha my attitude changed as quick as Barry Bonds' bench press. One thing I love about Starbucks is that it is not just about the coffee, its about a culture and consistent experience. I admire their business model and ability to create a brand that inspires incredible loyalty from both customers and employees. No matter where I am in the world when I step inside a Starbucks I feel at home, my wife and I call Starbucks a faithful friend.

Today's turmoil within Starbucks highlights an issue that all successful businesses must face as they grow, over-saturation. How much is too much growth? At what point does a company lose its soul and how can a company balance consistency in customer experience with aggressive growth. Even though the critics are in full force right now in regards to the demise of Starbucks I am confident that they will adapt and continue their success for three reasons:

1) Details - "Retail is detail." - Howard Schultz

Starbucks has taken Malcom Gladwell's advice and embraced the idea that, "little things can make a big difference." Walking into your local Starbucks is a lesson in product placement, design and attention to detail. Everything from the napkins to the furniture to the music selection and volume is intentional. Starbucks understands, better than almost anyone, that the smallest details matter in creating the right customer experience. This attitude is widespread throughout the company and is a pillar that Starbucks was built upon. As long as this doesn't change there is no reason why their company cannot continue to expand successfully.

2) Relaxed Affluence

One of the best-worded phrases I have heard to describe the image of Starbucks actually came from a management textbook, Strategic Management: Competitiveness and Globalization, I used in college which described the progress of Starbucks in China. "Although China is a nation of tea drinkers who generally don't care for coffee, Starbucks is counting on its image of relaxed affluence to attract the Chinese. " After returning from a trip to China, my wife's best friend Sarabeth (worked at Starbucks as a barista) told us how powerful the Starbucks image had become in the land of tea drinkers. Chinese would keep their Starbucks cups, fill them with water and tote them around as a status symbol to let their peers see that they had reached the socioeconomic level required to purchase this luxury item. Starbucks is a symbol of the ever-growing Bobo (bourgeois bohemian) class, coined by David Brooks, found grazing for the past decade or so in America at places like Anthropologie, Restoration Hardware, etc. The booming Chinese middle-class is birthing its own Asian Bobos...Starbucks understands this and will, therefore, continue their success in Asia.

3) Baristas

"Sometimes you want to go, where everybody knows your name, and they're always glad you came." - Cheers Theme Song. Every company talks about customer service, very few really know how to put words into action. The front-line workers of the Starbucks corporation are their baristas, the people who actually make and serve the coffee. They make Starbucks what it is. They intentionally memorize the names and drinks of customers to create an inviting atmosphere. I have never met a disgruntled barista. This isn't to say that they don't exist, but I have talked with several people who have worked for Starbucks and never heard anything, but pride at how the company served them as employees. Treating your employees well is good business because happy employees are more willing to go the extra mile for the customer and company alike. Starbucks gets this and this is the third reason they will continue to prosper.

Monday, November 12, 2007

Hell Hath No Fury: Strange Motivations for Runners

As some of you may know I began training for a marathon almost two months ago. The process has been very rewarding so far; I feel great, more energy, more relaxed, and with each run its easier and easier to get into a rhythm. Sundays are my long run days with Tuesdays and Thursdays as my short run days (Tuesdays sometimes become imaginary running days). Since I didn't get my long run in yesterday I had to do it tonight...it was by far the best run I've had and by far the most motivated I have been to push my limits...my motivation, fear of my wife.

As some of you may know I began training for a marathon almost two months ago. The process has been very rewarding so far; I feel great, more energy, more relaxed, and with each run its easier and easier to get into a rhythm. Sundays are my long run days with Tuesdays and Thursdays as my short run days (Tuesdays sometimes become imaginary running days). Since I didn't get my long run in yesterday I had to do it tonight...it was by far the best run I've had and by far the most motivated I have been to push my limits...my motivation, fear of my wife.

The run started off as it usually does, changing into my running shorts and shoes, charging my iPod, fine tuning my playlist, out the door, iPod on, earphones in...and off down the asphalt path to glory. The only exception, I started a bit late...as the sun was starting to go down. Last Sunday I had run 6 miles so my initial plan was to get at least 6 and 7 if I felt good.

Sure enough, about 3 miles in I was feeling it. The Killers, "When You Were Young" was jamming through my headphones and I felt light so I decided to take a detour and add an extra mile. The sun was going down about this time...the headlights were becoming more intense creating my own little version of Coldplay's "Fix You" music video. I completed the detour and popped back out onto my familiar route. By this time I was about halfway through my run, at the furthest point geographically from my house. Suddenly, it hit me, my wife and I had scheduled dinner with friends....at 7pm....it had to be about 6:30 or 6:45....CRAP!!!

I scrambled to remember when I had left the house...I remembered looking at the clock in the kitchen just before I stepped out the door and I was nearly certain it was around 6 when I left. I was doing mental calculations trying to determine my distance covered, average mile time, etc. My pace became much faster. This wasn't the first time in the past few weeks something like this had slipped my mind. Marelize had been incredibly patient, but I knew this wasn't going to be fun...she had told me just before I stepped out the door not to go on a long run...at the time I thought she just didn't want me running in the dark, now it made a bit more sense.

Mile 5: Pitch black, headlights racing by much too close on the narrow country road, sweating, windy...then the little devil hopped up on my shoulder. What was I going to say about this. I could see her now...her stance, her eyes...the look of disappointment. It was unbearable. For a normal woman it may not have been so bad, but my wife had a little extra bargaining chip on the table, she's currently 8 months pregnant. Thus, the excuses began to flow like wicked poetry. I stopped to help an old lady with car troubles, a pack of wild dogs chased me into an alley where I had to fend them off with a stick, I twisted my ankle and had to walk home....

Mile 6: At this point I was nearing a dead-out sprint. I'd almost settled on one of those quasi-truths, "I took a wrong turn." In fact I had...the turn where I kept going further away from home at mile 3 instead of turning back around. I could feel my heart pounding through my sternum and could hear my breathing muffled over the sound of my music....Fall Out Boy's "Sugar, We're Going Down," how appropriate. I began praying that God would give my wife a spirit of mercy and forgiveness.

Finally, after what seemed like 2 hours at a 6:30-mile pace I made it home. I had skipped my usual 1/2 mile cooldown walk and ran straight into the garage, preparing myself to look as exhausted and flustered as possible (this wasn't all to hard to act out). Bursting through the door I glanced at the clock....6:20! Are you serious!?! I didn't get it...evidently I had left about 5:30 instead of 6. Marelize cracked up as I explained the story to her. The rest of the night went well and I looked back at the incident thinking only one thing...it was the best run of my life. I'm a firm believer that physical training is 90% mental, the body will do almost anything the mind wants, the trick is finding the right motivation.

Posted by

Cameron Schaefer

at

6:36 PM

1 comments

![]()

Labels: Life, motivation, running

The Economist New Religion Issue

A recent issue of The Economist entitled, "The New Wars of Religion," ran an 18-page special on faith and politics...very good, although the generalizations made about Pentecostalism as the, "least intellectual (and most emotive) religion of all," were a just that, generalizations. Regardless, the article is well-worth the read as it captures very clearly the role and transformation of religion today. Below is a segment discussing the new role of choice in today's religious environment that I found most interesting:

A recent issue of The Economist entitled, "The New Wars of Religion," ran an 18-page special on faith and politics...very good, although the generalizations made about Pentecostalism as the, "least intellectual (and most emotive) religion of all," were a just that, generalizations. Regardless, the article is well-worth the read as it captures very clearly the role and transformation of religion today. Below is a segment discussing the new role of choice in today's religious environment that I found most interesting:

"Choice is the most “modern” thing about contemporary religion. “We made a category mistake,” admits Peter Berger, the Boston sociologist, who was once one of the foremost champions of secularisation but changed his mind in the 1980s. “We thought that the relationship was between modernisation and secularisation. In fact it was between modernisation and pluralism.” Religion is no longer taken for granted or inherited; it is based around adults making a choice, going to a synagogue, temple, church or mosque.

This has a profound affect on public life. The more that people choose their religion, rather than just inherit it, the more likely they are to make a noise about it. Miroslav Volf, director of Yale's Centre for Faith and Culture, says this is showing up in the workplace too: “It used to be that workers hung their religion on a coat rack alongside their coats. At home, their religion mattered. At work, it was idle. That is no longer the case. For many people religion has something to say about all aspects of life, work included.”

Saturday, November 10, 2007

2008: The Year to Buy a House?

Anyone who has caught a glimpse of the news over the past year has heard of the black cloud hanging over the American housing market in regard to the sub prime mortgage mess. Record numbers of home buyers defaulting on their loans has had a tremendous ripple effect on everyone from lending companies to major banks, and the U.S. real estate market has shown the strain. Prices have retreated and supply has grown as lenders have tightened down their lending policies and mass foreclosures have become common place. As the saga continues the question is whether 2008 will be the year to buy a house? This question has become personally relevant as my wife and I prepare to purchase our first home sometime next Spring depending on where the Air Force decides to send us after Pilot Training.

Anyone who has caught a glimpse of the news over the past year has heard of the black cloud hanging over the American housing market in regard to the sub prime mortgage mess. Record numbers of home buyers defaulting on their loans has had a tremendous ripple effect on everyone from lending companies to major banks, and the U.S. real estate market has shown the strain. Prices have retreated and supply has grown as lenders have tightened down their lending policies and mass foreclosures have become common place. As the saga continues the question is whether 2008 will be the year to buy a house? This question has become personally relevant as my wife and I prepare to purchase our first home sometime next Spring depending on where the Air Force decides to send us after Pilot Training.

After a little research the answer is mixed at best. For one, as real estate agents are often fond of saying, "real estate is local." Some markets are expected to continue their decline in 2008 at double digit rates while others, mainly those catering to vacation home buyers, may already be close to bottoming out. A recent CNNMoney.com article provided the following table listing those areas predicted to be hit worst by continuing declines in housing prices.

Secondly, the answer to whether or not to buy in '08 hinges on how long you plan on keeping your house after the purchase. While opinions on the time frame for a market turnaround are incredibly diverse, almost everyone agrees that in a few years the crisis should be over. Meaning, if you buy a house tomorrow, as long as you're not trying to flip it in the next year or two, you should be fine.

Keeping these things in mind the best thing for a potential buyer to do is scout the area and put their "House-Flipping for Dummies" book at the back of the shelf for the time being.

Barbara Corcoran, the real estate contributor to CNBC, MSNBC and NBC's TODAY show explains, "Give yourself a crash course on home prices in your area by visiting the open houses of homes similar to the one you've got your eye on. Then, get three competitive brokers to give you a cost estimate of what the home is worth. Once you're armed with information, you can put in an educated offer. A nice place to start is 15 percent below the asking price, if it's properly priced, or 15 percent below what you believe the value is if it's not.”

Here are some good sites that can also help you research the local markets by providing tons of great information on the prices of recently sold homes, for sale listing, neighborhood information, trends, etc.:

1) Zillow.com

2) Trulia.com

3) Redfin.com

As Marelize and I go on our own little journey through the world of the first-time home purchase next Spring I will be sure to keep you updated on the process.

Posted by

Cameron Schaefer

at

9:31 AM

![]()

Labels: finance, house, real estate

Thursday, November 8, 2007

Quote of the Day: Glenn Packiam

“To be conduits of change, we must be faithful stewards of the small, ordinary moments.” Glenn Packiam, Butterfly in Brazil

Great insight at a time when the individual has the most opportunity to create change in the history of the world. Sometimes big dreams overshadow the small details that will allow us to get to where we want to go. A life of impact is lived out everyday, making lots of good decisions over a long period of time.

World's Coolest Hotel Pools

To me there is nothing better than a nice swimming pool. I admit that growing up in Wyoming did not provide me with a prime environment for developing this love relationship...7-month long winters with biting 40mph winds don't exactly make it easy to trek outside in your swim shorts and flip flops. Maybe it was this depravity that made me appreciate the swimming pool more than most as I grew older and traveled around the globe. For this reason a recent post on one of my favorite weblogs, theCoolhunter, caught my eye..."The World's Coolest Hotel Pools." Here is a picture of one of them as well as the link to check out the rest. Enjoy!

Click Here to See More!

Tuesday, November 6, 2007

3 Investment Principles Every Young Person Should Know: #2 Pay Yourself First

If you want to create wealth you must either save more or spend less...that's it. Why is it so hard then? Most people have the best intentions when it comes to doing these things, but at the end of the month, when the bills and statements arrive, the letdown begins. You realize that your money has yet again pulled a Houdini and is no where to be found...where did it go...you stand there puzzled, your empty Starbucks cups and Hollywood Video receipts mock your weakness. And so the cycle goes...unless you make a change. Thus, the second of the three investment principles every young person should know:

#2: Pay Yourself First

Most people pay everyone else before they pay themselves. They hope at the end of the month they will have some money left over to put towards savings or investments, but it rarely happens, its too easy to spend money. Paying yourself first means exactly that: when you get your paycheck, before you start paying bills, going grocery shopping, filling your gas tank, etc....take a percentage and put it in savings or investments. If you do this you will never go a month without saving money. At the end of the month you will still probably spend all your money...its what we are all great at, but the savings will already be in the bank, safe and sound.

The easiest way to pay yourself first is to set up automatic fund transfers on the days you receive your paychecks. This way you won't even realize the money is gone, you'll budget and spend according to the new amount. Spending is largely psychological, if you start out with a smaller amount your mind will tell you that you have to spend less, be more frugal.

Finally, an example of the power of paying yourself first from financial educator David Bach, author of "The Automatic Millionaire":

"Let's assume you make $50,000 a year. That's about $2,000 every two weeks, which is how most people are paid. So to save 10 percent of your income, which is less than an hour a day of savings, you'd have to save $200 every two weeks -- or $14 a day.

If you invested $200 every two weeks for 35 years in a retirement account that earned an annual return of 10 percent what would you have? Quite a pot of gold: $1,678,293.78."

**Author's Note: I actually pay myself second, I give the first 10% of my income to my local church, also known as tithing...but the principle remains the same.

Posted by

Cameron Schaefer

at

7:32 PM

![]()

Labels: finance, investments

Monday, November 5, 2007

3 Investment Principles Every Young Person Should Know: #1 The Time Value of Money

Since my last post I have had time to read more of Ramit Sethi's, I Will Teach You To Be Rich blog. As I have read the articles and seen the demand for simple financial education...and after many discussions with friends it has become obvious to me that many college and twenty somethings have not been introduced to basic money and investment principles that most close to finance would consider fundamental. For the next few days I'll be laying out the three investment principles every young person should know.

#1 - The Time Value of Money

The basic premise of the time value of money is that all else being equal an investor is better off receiving a certain amount of money today than he is receiving that same amount of money in the future. Basically, money now is better than money tomorrow. To most people this is instinctive, of course you would want money NOW! But why? One would assume that the value of $1 today is equal to the value of $1 a year from now, but this assumption is wrong. The dollar received today is more valuable because of all the ways you can make it grow. Just by putting it in a savings account you'll at least earn interest on it, thereby increasing its future value Here is an example:

You are given the choice between

Option A: $100,000 today

Option B: $100,000 in 3 years.

Lets say you decide to take Option A and invest your $100,000 in a savings account with a simple annual rate of 5%.

Future value of investment at end of first year:

= ($100,000 x 0.05) + $100,000

= $105,000

Next you leave this money untouched and let interest continue to accumulate

Future value of investment at end of second year:

= $100,500 x (1+0.05)

= $110,250

These equations rolled together would be equivalent to:

Future Value = $100,000 x (1+0.05) x (1+0.05) OR

$100,000 x (1+0.05)^2

Using this logic after three years the value of the $100,000 would be:

= $100,000 x (1+0.05)^3

= $115,762.50

This equation allows us to calculate multiple years or periods of interest without having to add each period up individually and is the basis for one of the most basic finance equations out there:

Future Value = Present Value x (1+interest rate)^number of periods

NOW, before you zone out from too many numbers. Here is the bottom line. Option A, in this case, is $15,762.50 more valuable than Option B, who's future value is equal to its present value. And remember, this is just assuming you put the money into a savings account making 5% interest. Option A could in fact be much more valuable if you instead invested the money in the stock market which has averaged approximately %10 percent return per year over the past several decades.

Compounding interest (another discussion in itself) allows our youth to work for us in mighty ways so that the money we have today is in fact much more valuable than money we will have in the future. Albert Einstein was quoted as saying, “The most powerful force in the universe is compound interest.” Understanding the time value of money principle allows us to harness this force and create wealth.

Posted by

Cameron Schaefer

at

10:35 PM

![]()

Labels: finance, investments

Sunday, November 4, 2007

You're Young So You Should Get Rich

It amazes me the amount of financial advice availabe today. Books, seminars, blogs, dvds, etc. with the sole purpose of showing you how to make money. I'm all for it to be honest, the more information available the better....although there are a lot of crooks and idiots out there as well. So, you have to be careful who's advice you take. I found a blog yesterday entitled I Will Teach You To Be Rich by Ramit Sethi, a young Silicon Valley entrepreneur. While I admit I haven't had the time yet to read through all of his articles, I was in agreement with his general views on creating wealth. The principles below are from his blog with some extra info added in by yours truly. I post these because they are, in large part, the same principles that I have come up with as I've attempted to hack my way through the jungle of financial plans, solutions and gimmicks in my own life. Nothing cosmic...THERE ARE NO SECRETS...but sound advice to any college/twentysomething wanting to create a stable financial base:

-- Create and Maintain a detailed budget. Wesabe is an excellent site I use that helps you do this...best part, completely free! Upload your accounts, label transactions, set spending limits and you're on your way.

-- Get your credit report. A recent amendment to the federal Fair Credit Reporting Act requires each of the nationwide consumer reporting companies – Equifax, Experian, and TransUnion – to provide you with a free copy of your credit report, at your request, once every 12 months. To get these reports go to www.annualcreditreport.com

-- Make sure you're not paying fees on your bank accounts or credit cards.

-- Open a high-interest bank account. www.bankrate.com will give you a comparison of all the different banks and their interest rates.

-- Establish a savings goal of 20 to 30 percent of your income, if possible.

-- Open an investment account at a discount brokerage. Most of my friends that I talk to about this look at me with horror saying they just don't know what to do...believe me, brokerage houses don't get rich by making it hard for you to open an account with them. Call, ask questions, don't make any quick decisions. If you already use USAA they do a good job, I'm also a fan of American Funds...if you go the mutual fund route.

-- Fully fund 401(k)s and Roth IRAs. If you are over the age of 22 and do not have a Roth IRA set up, even if you don't contribute much yet, you are flushing money down the toilet. It takes literally a few minutes to set up an account that will allow you to grow money throughout your life TAX-FREE.

Posted by

Cameron Schaefer

at

2:00 PM

![]()

Labels: finance, investments

Saturday, November 3, 2007

3 Things To Live By

I read something great this morning in The Message. The last few verses in 1Corinthians 13:

"We don't yet see things clearly. We're squinting in a fog, peering through a mist. But it won't be long before the weather clears and the sun shines bright! We'll see it all then, see it all as clearly as God sees us, knowing him directly just as he knows us!

But for right now, until that completeness, we have three things to do to lead us toward that consummation: Trust steadily in God, hope unswervingly, love extravagantly. And the best of the three is love."

I have read these verses many times in other translations and heard them even more...isn't it amazing how familiarity allows you to gloss over a great message. Faith, hope and love...and the greatest is love...yeah, yeah, yeah. But, the Word of God is alive and active and this morning it got me. We have three things to do....this is obviously important, a direct command, a narrowing-down of seemingly endless duties. First we must trust steadily....steadily trust....in God. Then hope....lose hope and you die. Then love extravagantly....man, extravagantly...it seemed much more attainable when it was just little love at the end of the list....faith, hope and love. But, to love extravagantly is something different entirely. And not only that, it is the best of the three...love is the greatest.

Thursday, November 1, 2007

Real World vs. College

Ben Casnocha, an entrepreneur, author and college student who's blog I read quite frequently, recently posted some interesting thoughts on the difference between college and the real world. Although I've only been in the "real world" for just over a year I find the thoughts quite accurate. He writes:

"How much does college prepare you for the real world? That's a question I'll be thinking about in the coming months and years.

One big difference between college and the real world is that college is an information-rich environment which makes it very easy to track your progress (and be motivated) day-by-day.

In college you constantly receive reports on your progress. You turn in assignments, you receive grades. Rarely does a week go by without some affirmation or refutation of effort from an all-knowing expert (professor, advisor, whoever).

In the real world, best I can tell, the information you receive from your "market" (customers, boss, whoever) is far more ambiguous. Anyone who's built a company knows that months can go by without clear feedback about whether you're on the right track. Indeed, sometimes it takes months of unyielding effort with your head down before you figure out whether you're creating something of value.

The most successful people I've met in the real world have a tolerance for ambiguity and are self-motivated enough to take care of business even if there aren't routine, external validations or challenges.

So do college students get spoiled by the constant information delivery and assessments that's part of structured education? Is there a risk that such an explicit reward system will retard a student's ability to be intrinsically motivated? Will a student, upon graduation, be able to apply consistent effort without receiving a decisive "A" or "B" for each of his tasks?"

I honestly believe that the primary and secondary education systems create an even greater alter-reality when they focus so heavily on building a student's self-confidence. The reluctance of most teachers to hand out a D, C, or even B in some cases is ridiculous and is creating a generation in constant need of praise and affirmation...just ask the managers of today's companies.

Posted by

Cameron Schaefer

at

8:30 AM

1 comments

![]()

Friday, October 26, 2007

Ridiculously Good Music!

I've heard some really good music lately as I've perused the vast galaxy of iTunes. My ear is normally pretty good, but I rarely share my discoveries....I realize that is selfish, so here are some bands/songs you might consider taking a listen to in no particular order...some are new, some are not so new, but they all are just good:

THE BRAVERY - "Believe"

BAND OF HORSES - "Is There A Ghost"

DASHBOARD CONFESSIONAL - "The Shade of the Poison Trees"

RILO KILEY - "Silver Lining"

JASON MORANT - "Belong (Radio Mix)"

THE CINEMATIC ORCHESTRA - "To Build a Home"

THE KOOKS - "She Moves In Her Own Way"

Posted by

Cameron Schaefer

at

8:20 PM

2

comments

![]()

Labels: Music